minervadayton

About minervadayton

Understanding Personal Loans with Dangerous Credit: An Observational Examine

In today’s financial panorama, personal loans have emerged as a popular possibility for individuals looking for instant access to funds for numerous wants, ranging from medical bills to residence improvements. Nevertheless, for these with dangerous credit, the highway to acquiring a personal loan can be fraught with challenges. This observational research article goals to explore the dynamics of personal loans for people with unhealthy credit score, the implications of borrowing beneath such situations, and the potential alternate options obtainable.

Defining Dangerous Credit

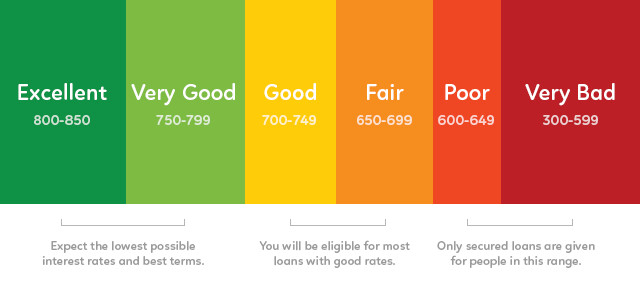

Earlier than delving into the specifics of personal loans, it is essential to grasp what constitutes unhealthy credit. Credit score scores sometimes range from 300 to 850, with a score beneath 580 considered poor. People with unhealthy credit score often struggle to safe loans from traditional lenders, resembling banks and credit unions, because of perceived dangers associated with their repayment ability. This creates a major barrier for these in want of financial help.

The Landscape of Personal Loans for Bad Credit

The marketplace for personal loans catering to individuals with bad credit has expanded in recent years. Lenders, together with online platforms and alternative monetary institutions, have acknowledged the potential profitability in serving this demographic. These lenders usually employ completely different standards for evaluating creditworthiness, focusing much less on credit score scores and extra on factors corresponding to income, employment history, and current debt levels.

One frequent characteristic of personal loans for bad credit is higher curiosity rates. Lenders compensate for the elevated danger of default by charging borrowers more. Curiosity charges can vary from 10% to 36%, relying on the lender and the borrower’s monetary profile. Whereas these loans present quick access to money, the lengthy-time period monetary implications can be significant, leading borrowers into a cycle of debt if not managed fastidiously.

Borrower Demographics and Motivations

Observational research signifies that people seeking personal loans with bad credit come from various backgrounds. Many are young adults who could have recently entered the workforce and have restricted credit score histories. If you have any kind of questions regarding where and ways to utilize personalloans-badcredit.com, you could contact us at our web-site. Others may be older individuals who’ve faced monetary hardships, reminiscent of medical emergencies or job losses, resulting in a decline of their credit score scores.

The motivations for seeking personal loans range. Some borrowers are looking to consolidate current debt, hoping to handle their funds extra successfully by combining multiple funds into one. Others may have funds for unexpected bills, reminiscent of automotive repairs or medical payments, that cannot be postponed. Regardless of the explanation, the urgency of their needs often outweighs the potential drawbacks of excessive-curiosity loans.

The applying Process

The appliance process for personal loans with bad credit score is generally more accessible than traditional loans. Many online lenders offer quick purposes that can be completed in minutes, with approvals often granted inside hours. This comfort is appealing to borrowers in pressing need of funds. However, the benefit of access can even result in impulsive borrowing selections, with individuals taking on extra debt than they can realistically handle.

Throughout the applying course of, lenders typically require primary private information, proof of income, and details concerning current debts. Some lenders may additionally conduct a soft credit verify, which doesn’t influence the borrower’s credit rating, while others might perform a tough inquiry, which might briefly lower the rating further. This aspect of the borrowing process will be notably regarding for individuals already struggling with poor credit.

Challenges and Dangers

Whereas personal loans can provide instant relief for borrowers with dangerous credit score, in addition they include inherent risks. Essentially the most urgent concern is the potential for falling into a debt trap. High-curiosity rates can lead to a situation the place borrowers are unable to make timely funds, leading to extra fees and additional harm to their credit score scores. This cycle can create a way of hopelessness for many people.

Furthermore, the lack of monetary literacy among some borrowers can exacerbate the scenario. Many individuals could not fully understand the terms of their loans, resulting in misunderstandings relating to repayment schedules, interest calculations, and potential penalties. This lack of knowledge can leave borrowers vulnerable to predatory lending practices, the place unscrupulous lenders make the most of their monetary desperation.

Options to Personal Loans with Dangerous Credit score

Recognizing the potential pitfalls of personal loans, it is essential to explore various choices for people with bad credit score. One viable alternative is credit counseling, which may present borrowers with beneficial insights into managing their finances and improving their credit score scores over time. Credit counselors may also help create budgets, negotiate with creditors, and develop a plan for debt repayment.

Another option is secured loans, where borrowers use collateral, corresponding to a automobile or financial savings account, to secure the loan. These loans sometimes include decrease interest charges, as the lender has a lowered risk as a result of collateral backing the loan. However, borrowers should be cautious, as failing to repay a secured loan can result in the loss of the asset used as collateral.

Peer-to-peer lending platforms also present an alternative for people with dangerous credit score. These platforms join borrowers instantly with particular person buyers who are willing to fund loans. While curiosity rates should still be increased than traditional loans, the terms can typically be more favorable, and the process is commonly more clear.

Conclusion

In conclusion, personal loans for individuals with unhealthy credit serve a important want in the financial ecosystem, offering access to funds for these facing financial challenges. Nevertheless, the associated dangers and potential for debt accumulation can’t be missed. It is crucial for borrowers to approach these loans with caution, totally understanding the terms and implications before committing. Exploring various options, resembling credit score counseling and secured loans, can provide people with a extra sustainable path to financial recovery. Finally, fostering financial literacy and responsible borrowing practices will empower individuals to make knowledgeable decisions and enhance their lengthy-term financial effectively-being.

No listing found.